Financial Technology, commonly known as Fintech/ˈfɪntɛk/ is a process of using modern technology to make handling money easier, faster, and more accessible for individuals. It’s like having a digital financial assistant in your pocket. Imagine being able to pay for your groceries, send money to a friend, or invest in stocks, all from your smartphone—that’s Fintech at work.

In simpler terms, Fintech takes the complex systems used by banks and financial institutions and turns them into user-friendly apps and services. It’s like replacing a visit to a bank with a few taps on your phone. Fintech makes use of software and algorithms to help you manage your financial life without the need for traditional, physical banking services.

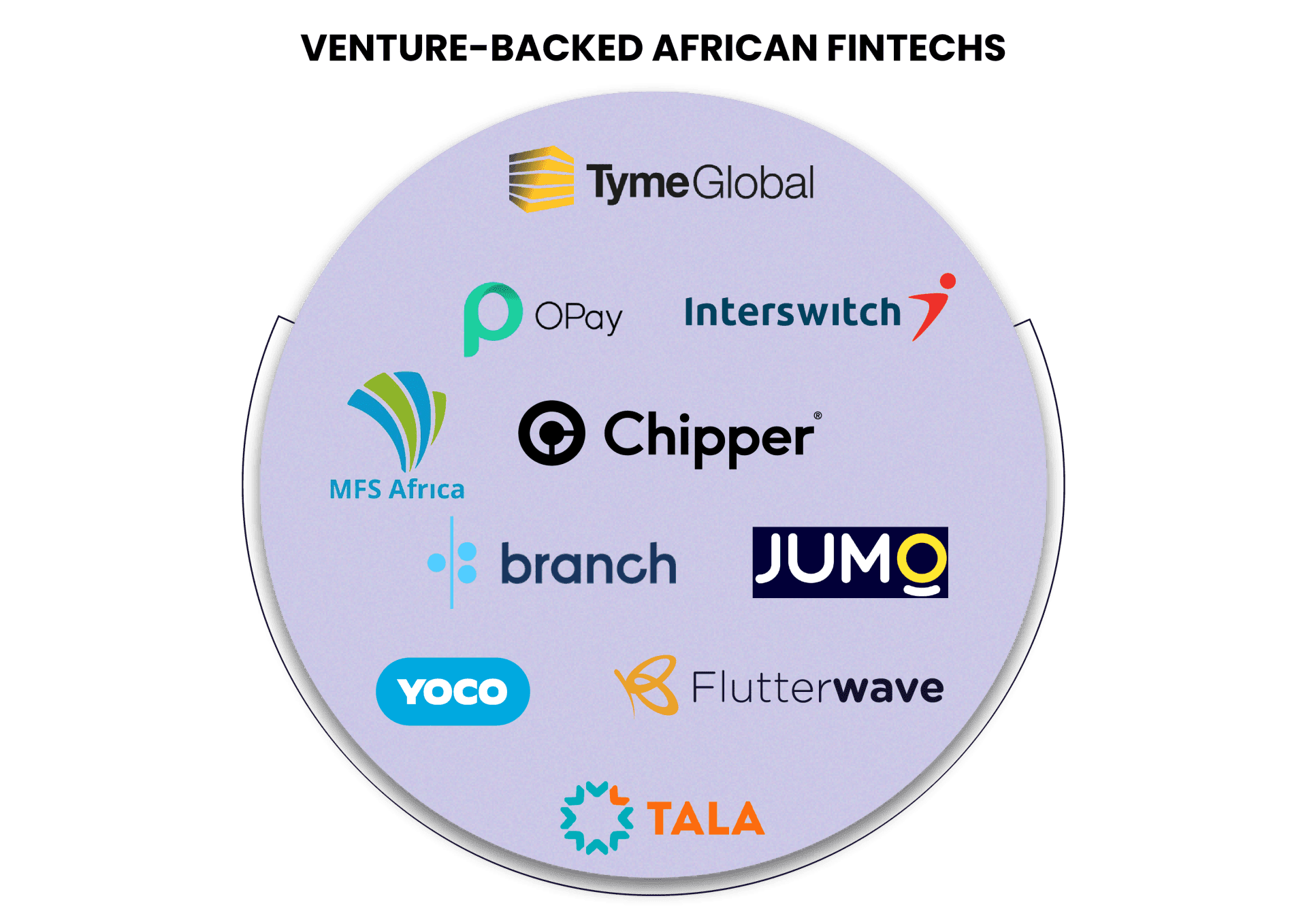

Over the years, we’ve witnessed a transition in the finance world. Gone are the days when the safest bank was a hidden hole in the ground, and sending money to a relative meant a long journey on foot, or trusting a traveler with your cash. Fast forward to today, and the landscape of finance has been revolutionized by Financial Technology (Fintech). The story of Fintech in Africa is one of remarkable transition. It’s a narrative that has seen the continent move from the days of ‘money pots’ and postal orders to a present where financial services are at the fingertips of the many, not just the few. This digital revolution has been spearheaded by amazing companies that have become household names across the continent. Take Piggyvest for example, a pioneer that makes savings and investments seamless. Then there’s Flutterwave, which has made cross-border transactions as simple as sending an email. Paystack and OPay have transformed the way businesses and individuals think about payments, while Jumo and Fawry have opened up new possibilities for lending and saving.

These Fintechs are not just companies; they are the architects of a new financial era in Africa. They have laid the foundations for a future where financial inclusion is not just an aspiration, but a reality.

For example, if you’ve ever used a mobile app to check your bank balance, paid someone using a service like Opay or Moniepoint, or managed your investments through an online platform, you’ve used Fintech. It’s a big umbrella that covers everything from online banking and mobile payment apps to cryptocurrencies like Bitcoin.

Despite the rise of Fintech in Africa, individuals still encounter several challenges when using these innovative apps.

Firstly, digital literacy remains a significant hurdle for many users. While Fintech apps aim to simplify financial transactions, not everyone is equally comfortable with technology. This disparity in digital skills can limit the accessibility of these apps, especially in rural or less tech-savvy areas.

Secondly, reliable internet connectivity is essential for using Fintech apps seamlessly. However, inconsistent network coverage in some regions can hinder access to these services, thereby restricting their reach and usability.

Furthermore, security concerns loom large in the minds of potential users. With the convenience of digital transactions, comes the risk of cybersecurity threats such as hacking, identity theft, and fraud. Many individuals may be hesitant to adopt Fintech solutions due to concerns about the safety and security of their personal and financial information.Additionally, a significant portion of the population in Africa remains unbanked or underbanked, despite the proliferation of Fintech solutions.

This lack of access to traditional banking services can pose a barrier to using Fintech apps effectively, further exacerbating financial exclusion in certain communities.

Lastly, users may encounter unexpected fees or hidden charges when conducting transactions through Fintech apps. These fees can vary between different platforms and may disproportionately affect low-income users, potentially undermining the affordability and accessibility of these services.

Looking ahead, Fintech companies have a crucial role to play in enhancing accessibility, security, and affordability, thereby driving greater financial inclusion and empowerment for all Africans.

By investing in digital literacy initiatives, expanding internet infrastructure, and prioritizing user security, Fintech firms can pave the way for a more inclusive and sustainable financial future.

SIGN UP ON CARSLE